You're checking your bank account when you spot an unexpected deposit labelled "Canada RIT." Your first thought? Is this legitimate, or should you be worried? If you're like most Canadians, seeing an unplanned government deposit can trigger a mix of excitement and confusion.

The good news is that a Canada RIT deposit is typically cause for celebration, not concern. This deposit represents money the Canada Revenue Agency owes you - whether from overpaid taxes, unclaimed tax credits, or government benefits you're entitled to receive. However, understanding exactly what triggered your deposit and how to make the most of this financial boost requires some guidance.

In this comprehensive guide, we'll walk you through everything you need to know about Canada RIT deposits. From understanding what triggers these payments to verifying their legitimacy and making smart financial decisions with your refund, you'll have all the tools to confidently manage this unexpected addition to your finances.

Key Takeaways:

- Canada RIT stands for "Refund of Income Tax" - money the Canada Revenue Agency owes you

- Canada RIT deposit appears when you've overpaid taxes or qualify for additional tax credits

- Tax refund timing depends on when you filed your taxes and CRA processing times

- Direct deposit is the fastest way to receive your Canada RIT payments

- Not taxable - your Canada RIT deposit is simply your own money being returned

- Verify legitimacy by checking your CRA account for Notice of Assessment details

What is Canada RIT?

Canada RIT stands for "Refund Income Tax" - essentially, it's free money that the Canada Revenue Agency (CRA) owes you. When you see a Canada RIT deposit in your bank account, it means you've either overpaid your taxes or qualify for government benefits and tax credits you weren't previously receiving.

The Canada Revenue Agency CRA processes millions of tax returns annually. When they determine you're owed money, they issue a Canada RIT payment directly to your bank account or send a paper cheque. This isn't just free money - it's your own money being returned after you overpaid your tax liability.

What Triggers a Canada RIT Deposit?

Tax Reassessment by CRA

The most common reason for receiving Canada RIT payments is a tax reassessment. Even after you've filed your taxes, the Canada Revenue Agency can review your income tax return for up to three years. If they discover you're entitled to more tax credits or deductions, you'll receive a Notice of Assessment showing your bigger tax refund.

Over-Withholding by Employers

Throughout the tax year, your employer deducts income tax from each paycheck. If your personal circumstances change - marriage, having children, or qualifying for new government benefits - your employer might not adjust these deductions. This results in tax deducted exceeding what you actually owe, leading to a Canada RIT.

Unclaimed Tax Credits and Government Benefits

Many Canadians miss out on valuable tax credits like:

- Canada Child Benefit for families with children

- Ontario Trillium Benefit for low-to-moderate income residents

- Canada Workers Benefit for working individuals

- Small Business Job Credit for entrepreneurs

When the CRA identifies these missed opportunities, they automatically apply them to your tax return, resulting in Canada RIT payments.

Excess Tax Installments

Self-employed individuals and those with multiple income sources often make quarterly tax payments. If you overestimated how much tax you'd owe, your excess payments trigger a RIT deposit when you file your Canadian tax return.

First Home Savings Account Contributions

Contributing to a First Home Savings Account provides tax deductions that can increase your tax refund. If you contributed but didn't claim the deduction initially, the CRA may reassess and send a Canada RIT deposit.

How to Verify Your Canada RIT Deposit

Check Your CRA Account

Before celebrating, verify your Canada RIT deposit is legitimate by logging into your CRA account. Look for:

- Recent Notice of Assessment or reassessment

- Payment history showing the RIT deposit

- Correspondence explaining the refund

Review Your Bank Account Statement

Your bank statement will show "Canada RIT" or sometimes "Canada RIF" (which means the same thing). Some financial institutions display it as "EFT Credit Canada" or "Canada Fed Deposit."

Contact CRA if Unsure

If you can't find documentation explaining your Canada RIT deposit, call the Canada Revenue Agency at 1-800-959-8281. Don't assume it's a mistake from the CRA - they rarely issue payments in error.

Who Qualifies for Canada RIT Deposits?

Any Canadian who filed their taxes and either:

- Overpaid their tax liability during the tax year

- Qualifies for government benefits they didn't initially receive

- Had their tax situation reassessed in their favour

- Made excess tax installment payments

Whether you're employed, self-employed, or receive retirement income, you could qualify for Canada RIT payments if you've overpaid taxes or missed claiming eligible tax credits.

How to Receive Your Canada RIT Deposit

Direct Deposit (Recommended)

Set up direct deposit through your CRA account for the fastest delivery of Canada RIT payments. This method typically delivers your tax refund within:

- 8 business days for online filers

- Up to eight weeks for paper return filers

Paper Cheque

If you haven't set up direct deposit, the CRA will mail a paper cheque to your address on file. This method takes longer and risks delivery issues.

Investment Account Deposits

You can also direct your Canada RIT deposit to investment accounts like:

- Registered Retirement Savings Plan (RRSP)

- Tax Free Savings Account (TFSA)

- Registered Education Savings Plan (RESP)

Timing of Canada RIT Payments

Unlike government benefits with set payment dates, Canada RIT deposit timing varies based on:

When You Filed Your Taxes

- File online: Faster processing, typically 8 business days for refunds

- Paper return: Slower processing, potentially requiring manual review

Complexity of Your Tax Return

Simple returns process faster than those requiring manual review for multiple income sources or complex tax deductions.

Outstanding Government Debts

If you owe money to the government from previous tax years or CERB overpayments, your Canada RIT refund may be applied to these debts first, reducing your deposit amount.

CRA Processing Delays

During peak tax season or staffing challenges, processing times may extend beyond normal timelines.

Smart Ways to Use Your Canada RIT Deposit

Pay Down High-Interest Debt

Use your Canada RIT deposit to eliminate high-interest debt, such as credit cards. The money you save on interest payments provides immediate returns on your tax refund.

Build Your Emergency Fund

Financial experts recommend 3-6 months of expenses in an emergency fund. Your Canada RIT payments can help establish or strengthen this financial safety net.

Maximize Tax-Advantaged Accounts

Consider contributing your RIT deposit to:

- RRSP: Reduces next year's taxable income

- TFSA: Growth and withdrawals are tax-free

- RESP: Government matching grants for your child's post-secondary education

- First Home Savings Account: Tax deductions plus tax-free growth for first-time homebuyers

Invest in Professional Development

Use your tax refund for courses, certifications, or training that enhance your earning potential and may qualify for additional tax deductions.

Home Improvements

Strategic home improvements can increase property value and may qualify for home renovation tax credits in some provinces.

Canada RIT vs Other Deposits

Canada RIT vs RIF

"Canada RIF" on your bank statement means the same as Canada RIT. However, if you claim retirement income, RIF might refer to Retirement Income Funds - withdrawals from registered retirement accounts.

Canada RIT vs Government Benefits

Unlike regular government assistance payments with scheduled payment dates, Canada RIT deposits are one-time refunds based on your specific tax situation.

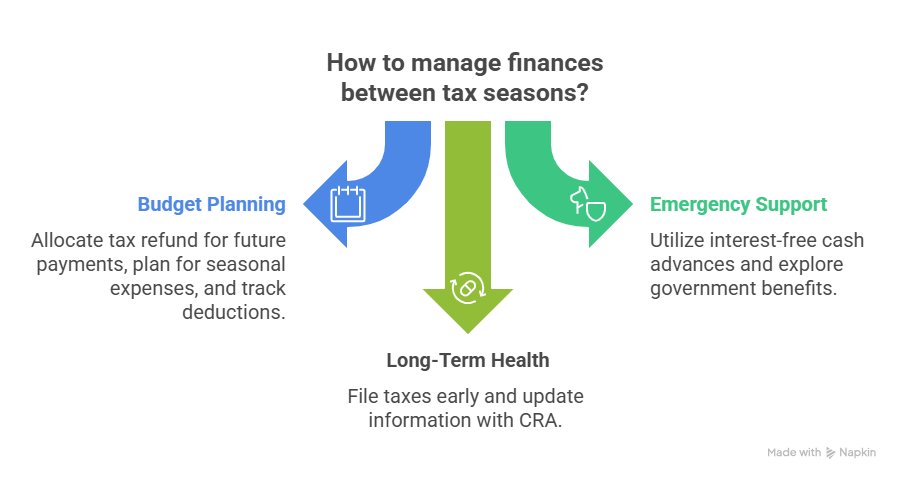

Managing Your Finances Between Tax Seasons

While Canada RIT deposits provide welcome financial relief, unexpected expenses can arise throughout the year. Here are strategies for maintaining financial stability:

Budget Planning:

- Set aside portions of your tax refund for upcoming tax payments

- Plan for seasonal expense variations

- Track your income tax deductions throughout the year

Emergency Support:

- If you need help between tax seasons, consider interest-free cash advances through services like Bree (up to $750 with no fees)

- Explore other government benefits you may qualify for

- Contact local community services for additional financial assistance

Long-Term Financial Health:

- File your tax return early to receive refunds sooner

- Keep your address and banking information current with CRA

- Review your tax situation annually to optimize your refund

Also read: Apps Like Nyble to Consider

Frequently Asked Questions

How much can I receive with Canada RIT?

Your Canada RIT deposit depends on how much tax you overpaid and what tax credits you qualify for. Some people receive a few hundred dollars, while others get several thousand based on their tax entitlement.

Is my Canada RIT deposit taxable?

No, Canada RIT deposits are not taxable income. This money represents overpaid taxes or tax credits you're entitled to - it's your own money being returned.

How often do I get Canada RIT payments?

Most Canadians receive one Canada RIT deposit per year when their tax refund is processed. However, if your return gets reassessed later, you might receive additional payments.

What if I receive a Canada RIT deposit I don't think I'm entitled to?

Check your CRA account first for explanations. If you still believe it's an error, contact the CRA immediately. Don't spend money that isn't rightfully yours.

Can I choose where my Canada RIT deposit goes?

Yes, you can direct your refund to different accounts, including savings accounts, investment accounts, or split it between multiple accounts through your CRA account settings.

Conclusion

Discovering a Canada RIT deposit in your bank account is generally excellent news for your financial well-being. Whether it's from overpaid taxes, unclaimed tax credits, or government benefits you're entitled to receive, this money represents funds that rightfully belong to you.

The key to maximizing your Canada RIT deposit lies in understanding why you received it and making informed decisions about how to use it effectively. Whether you choose to pay down high-interest debt, build your emergency fund, or invest in tax-advantaged accounts like an RRSP or TFSA, your tax refund can serve as a powerful tool for improving your financial stability.

While waiting for tax refunds and government benefits, unexpected expenses don't pause. If you find yourself needing financial support between Canada RIT payments, remember that help is available. Join Bree today to access interest-free cash advances up to $750 - helping you maintain financial stability without the burden of payday lender fees. Your financial wellness journey deserves support every step of the way, not just during tax season.

Join our newsletter to get the latest updates

%20(1).jpg)